Last updated on January 8th, 2026 at 11:23 pm

Download PAN card PDF online, PAN card download online, How to download e-PAN card, How to download PAN card PDF from NSDL, How to download PAN card using UTIITSL portal, How to download PAN card using Aadhaar number, Download new e-PAN card free, ऑनलाइन पैन कार्ड PDF कैसे डाउनलोड करें, फ्री ई-पैन कार्ड डाउनलोड ऑनलाइन, Know all about your query.

Download PAN Card PDF Online Instantly-अपना PAN Card PDF अभी डाउनलोड करें।

The Permanent Account Number (PAN) is one of the most essential identity documents in India. From opening a bank account to filing taxes, your PAN is required everywhere. But here’s the good news—you don’t always need a physical card. You can easily Download PAN card PDF online in just a few minutes.

So, if you’re wondering how to download PAN card PDF online, this guide will walk you through every possible method, whether you want to download from NSDL, UTIITSL, Income Tax Portal, or DigiLocker.

Different Ways to Download PAN / e-PAN Card

There are multiple ways to download your e-PAN:

- NSDL Portal (if you applied via NSDL)

- UTIITSL Portal (if you applied via UTIITSL)

- Income Tax e-Filing Portal (instant e-PAN for Aadhaar-linked users)

Let’s break each one step by step.

WhatsApp Channel

INCOME TAX DEPARTMENT OF INDIA

| Name of Article | How to Download PAN Card PDF Online |

| Objective | Download PAN Card PDF Online |

| Mode | Online |

| Charges/Fee | Free of Cost / Nominal Fee |

| Official Website | CLICK HERE |

Fee to Download PAN Card PDF Online

An e-PAN is usually free to download within 30 days of issuance. After that period, a small fee may apply — typically ranging from ₹8.26 to ₹66, depending on the portal you use (NSDL, UTIITSL, or others).

The e-PAN can be downloaded free of cost only by those who apply through the instant PAN service on incometax.gov.in Portal.

e-PAN has the same validity as the original PAN card and it is accepted across banks, tax authorities, and other institutions.

Requirement to Download Pan Card PDF Online

To download your PAN Card PDF online, you usually don’t need to upload any physical documents. However, you must have the following:

✅ PAN Number – Your 10-digit Permanent Account Number

✅ Date of Birth / Incorporation – As per PAN records

✅ Aadhaar Number – Mandatory for e-PAN download or instant PAN

✅ Linked Mobile Number – For OTP authentication (Aadhaar किस नंबर से Linked है? अभी चेक करें)

✅ Linked Email ID – Optional, but recommended to receive e-PAN copy

📌 Note:

- No physical documents need to be uploaded.

- Ensure your mobile number is linked to Aadhaar or PAN for successful OTP verification.

- For Aadhaar-based instant PAN, only Aadhaar and linked mobile number are needed.

Read Also:

Step-by-Step Guide: How to Download Pan Card PDF Online

PAN नहीं है? Get your FREE PAN instantly Today! [👈Click Now]

Download e-Pan Card through Income Tax e-Filing Portal

The Income Tax e-Filing Portal is one of the most convenient and free of cost platforms to download your e-PAN, especially if your PAN is already linked with Aadhaar. This method is most effective for taxpayers who have applied for a new PAN through the Instant PAN service on the Income Tax e-Filing Portal. Here’s the process step by step:

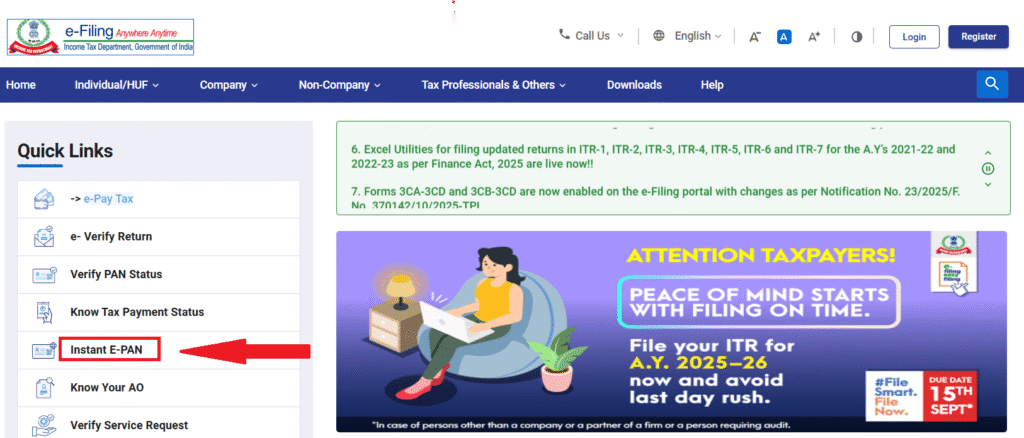

Step 1: Visit the Income Tax e-Filing Portal (https://www.incometax.gov.in).

Step 2: From the Quick Links section on the homepage, click on Instant e-PAN.

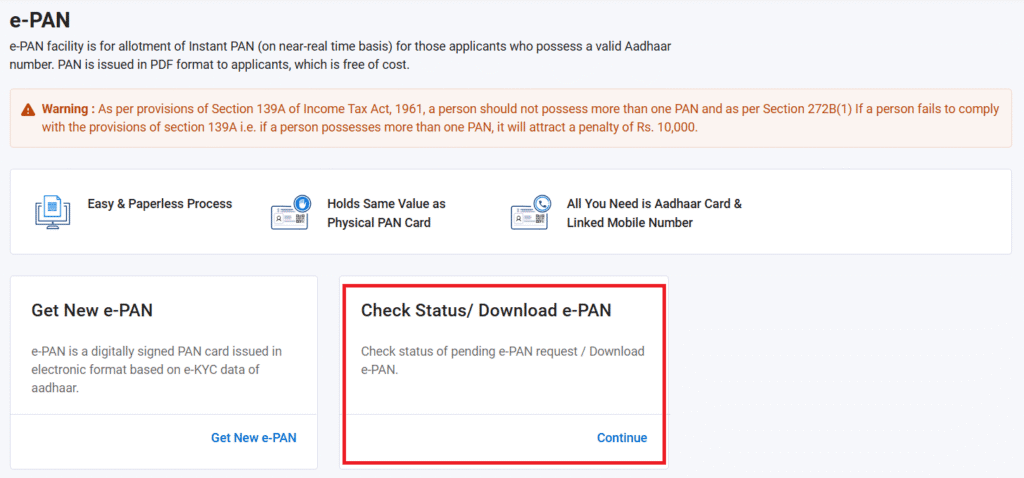

Step 3: Click on Check Status/ Download e-PAN.

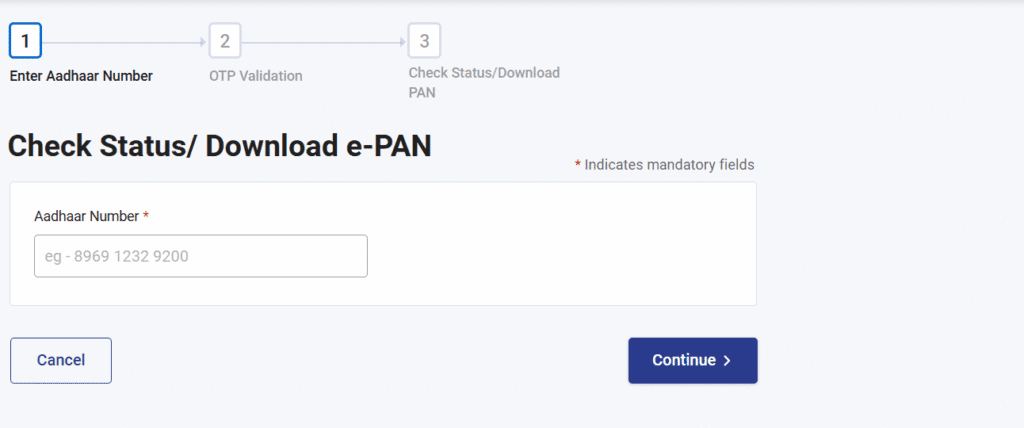

Step 4: Enter your Aadhaar number and click on Continue.

Step 5: Authenticate your Aadhaar using the OTP sent to your registered mobile number.

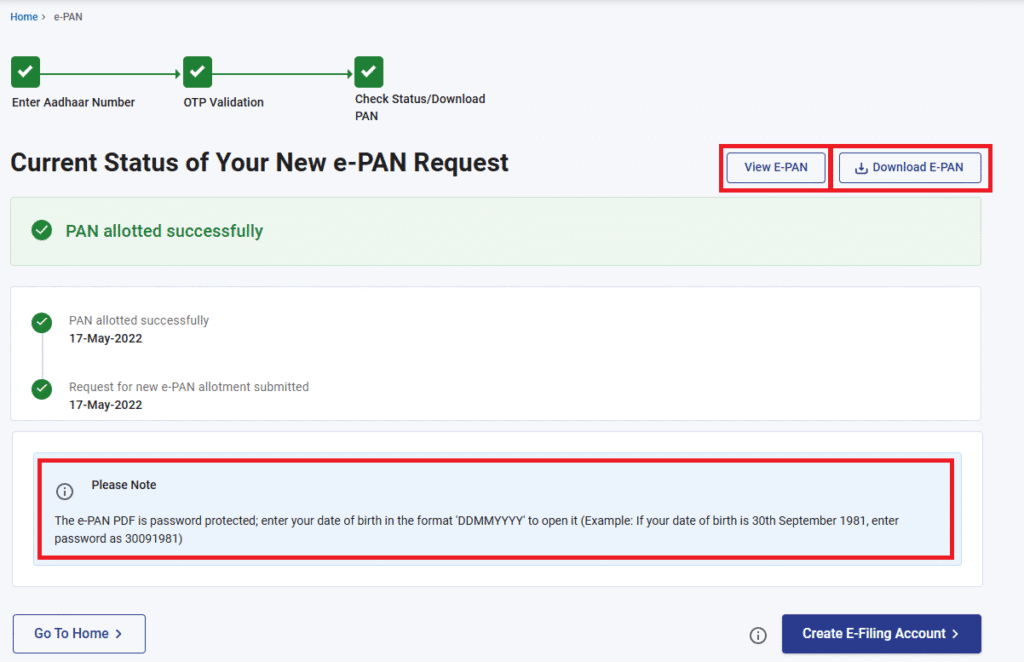

Step 6: Once your Aadhaar details are successfully verified, you’ll see two options on the screen – View e-PAN and Download e-PAN. Simply click on Download e-PAN to Download e-PAN instantly in PDF format.

Advantages of downloading from the e-Filing portal:

- Absolutely free for all eligible users.

- No need to remember PAN or acknowledgment number, only Aadhaar based authentication.

- Instant access—perfect for emergencies.

Who can use this option?:

- Individuals whose PAN is already allotted from The Income tax e-filing Portal

- PAN and Aadhaar must be linked.

- The mobile number should be registered with Aadhaar.

You will receive your e-PAN card in PDF format on your registered email ID. You can also download it directly from the portal. The PDF is password-protected, and the password is your Date of Birth in DDMMYYYY format.

Step-by-Step Guide to Download e-PAN PDF from NSDL

The NSDL (Protean eGov) portal is one of the most widely used platforms for PAN services in India. If you applied for your PAN through NSDL, this is the best place to download your e-PAN card PDF. Here’s a step-by-step guide:

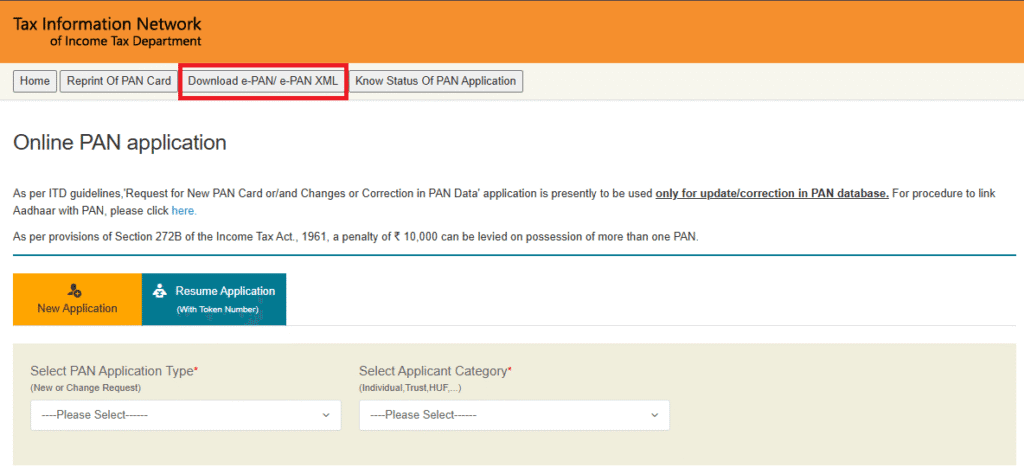

Step 1: Go to the official NSDL PAN Services Portal.

Step 2: On the homepage, look for the option ‘Download e-PAN Card’ and click on it.

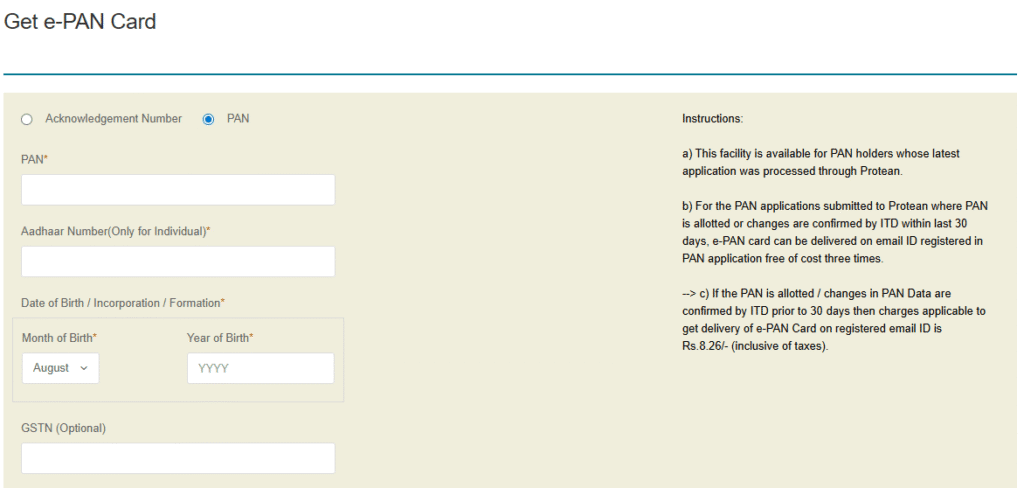

Step 3: Now, enter your PAN number or Acknowledgement number, along with your Aadhaar number and Date of Birth. Tick the consent box, complete the “I am not a robot” reCAPTCHA, and then click on Submit.

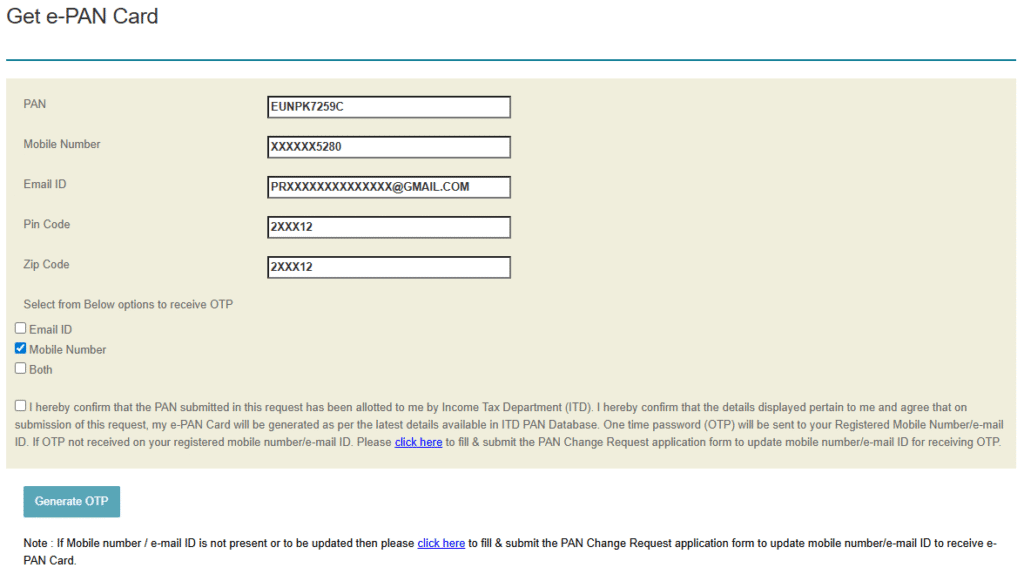

Step 4: Next, choose the option to receive OTP, tick the consent box, and then click on Generate OTP.

Step 5: Enter the OTP received on your registered mobile number or email and click on Validate to continue.

Step 6: If you are downloading your e-PAN within 30 days of issue/reprint, it is free. Check your mail, you will receive e-Pan Instantly after validation of OTP.

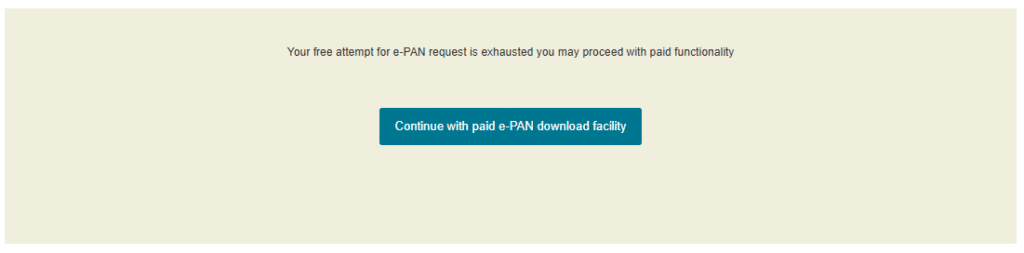

Step 7: If after 30 days, you need to make a payment of ₹8.26 (including taxes), Click on Continue with paid e-PAN download facility.

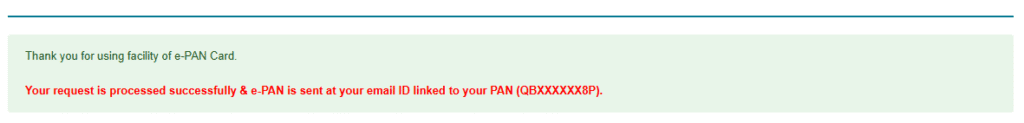

Step 8: After payment, click on Generate and Print Payment Receipt. Now your request is processed successfully and e-PAN is sent at your Email ID linked to your pan.

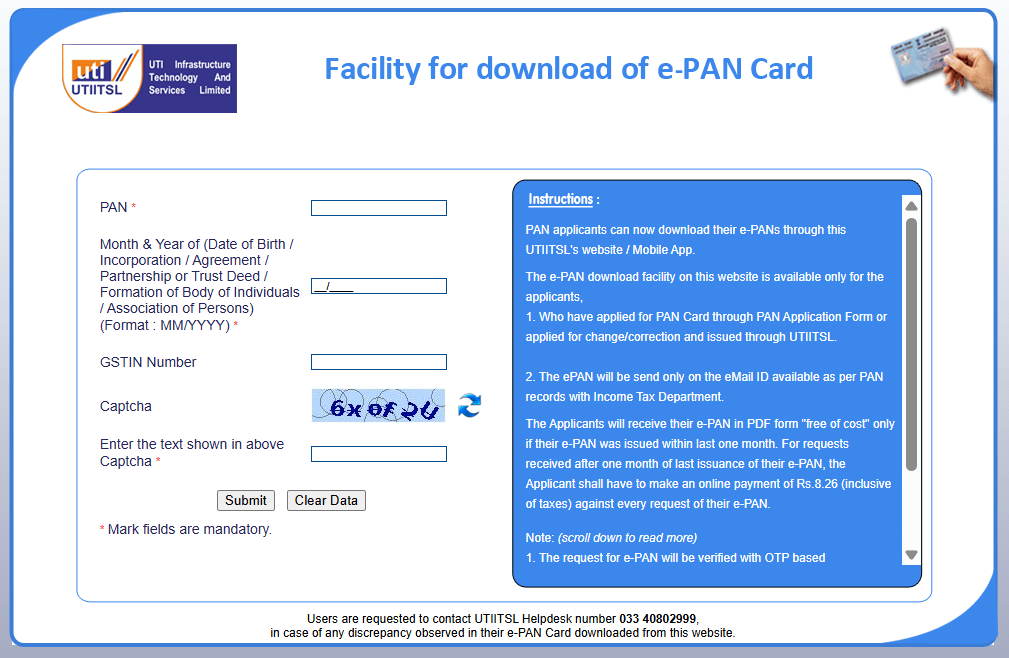

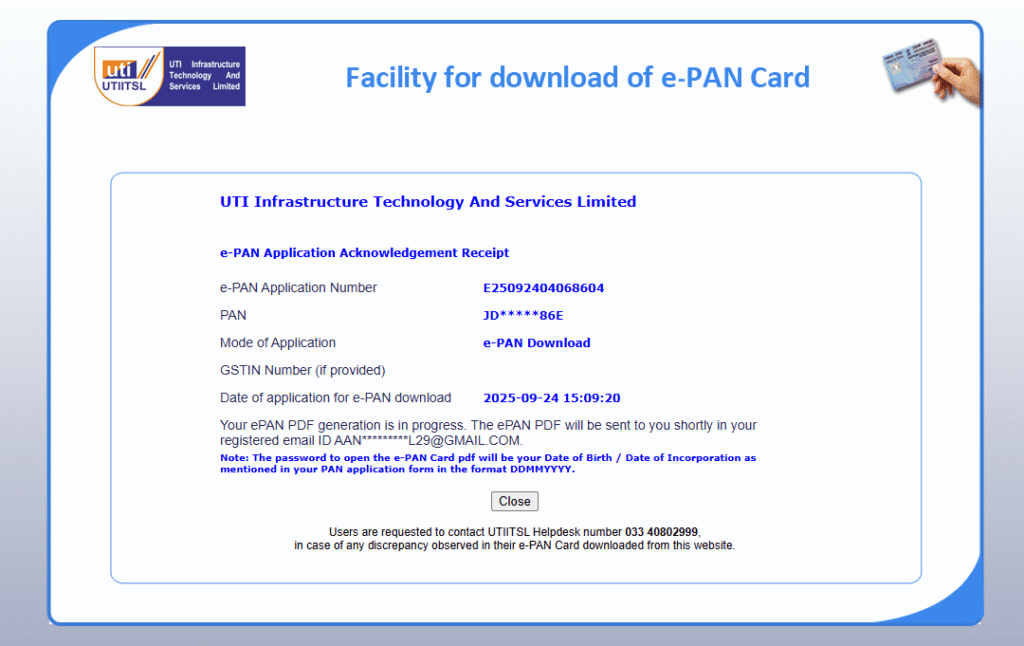

Step-by-Step Guide to Download e-PAN PDF from UTIITSL

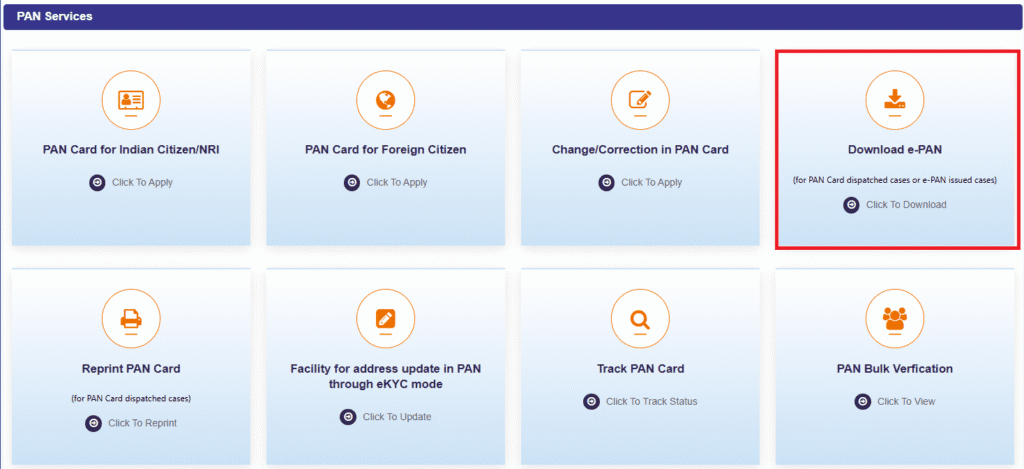

If you got your PAN card through UTIITSL (UTI Infrastructure Technology and Services Limited), then you can easily download your e-PAN PDF from the UTI portal. Just like the NSDL website, UTIITSL also lets both new applicants and existing PAN card holders download their PAN card in a digital format. Here’s a simple step-by-step guide to help you:

Step 1: Go to the official UTIITSL PAN Services Portal.

Step 2: On the homepage, look for the Download e-PAN option and click on it. This will take you to the e-PAN download page.

Step 3: Next, enter your PAN number and Date of Birth, fill in the captcha code, and then click on the Submit button.

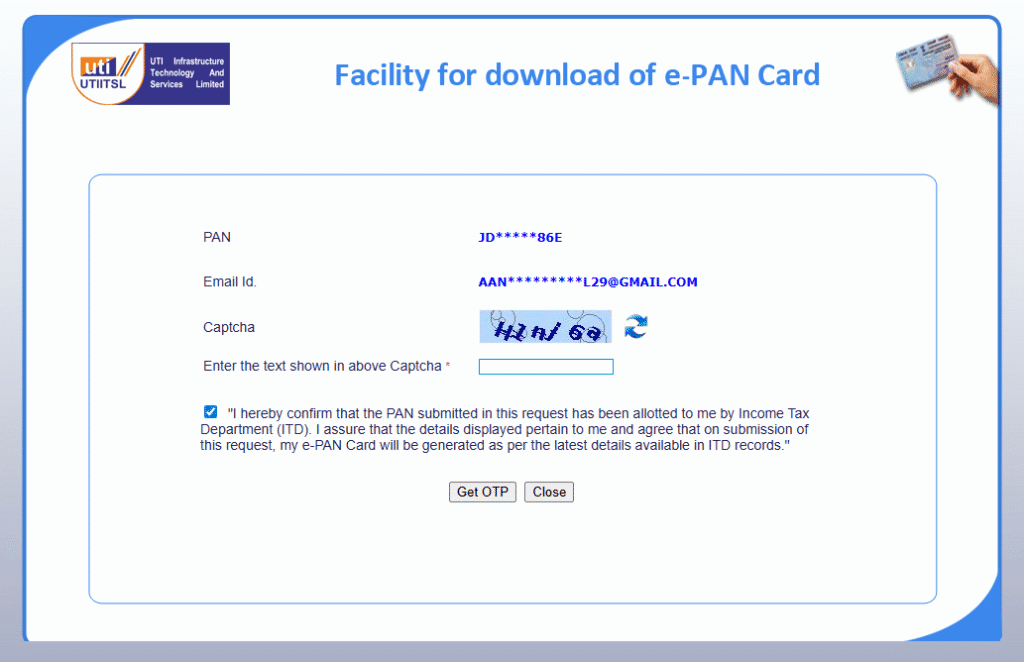

Step 4: Confirm your contact details, type the captcha, tick the consent box, and then click on Get OTP.

Step 5: Enter the OTP received on your registered mobile number or Email ID and click on Submit to continue.

Step 6: If you are downloading your e-PAN within 30 days of issue/reprint, it is free. Check your mail, you will receive e-Pan Instantly after validation of OTP.

Step 7: If after 30 days, you need to make a payment of ₹8.26 (including taxes), Click on Continue with paid e-PAN download facility.

Step 8: After payment, click on Generate and Print Payment Receipt. Now your request is processed successfully and e-PAN is sent at your Email ID linked to your pan.

Downloading your e-PAN card online is no longer a complicated process—it’s simple, fast, and accessible to everyone. Whether you use the NSDL portal, UTIITSL, the Income Tax e-Filing portal, or even DigiLocker, there’s always a reliable method available. The best part is that your e-PAN holds the same legal validity as the physical PAN card, making it a perfect digital substitute.

You will receive your e-PAN card in PDF format on your registered email ID. You can also download it directly from the portal. The PDF is password-protected, and the password is your Date of Birth in DDMMYYYY format.

Read Also:

| IMPORTANT LINK | |

| APPLY FOR FREE PAN | CLICK HERE |

| UPDATE VOTER ID ONLINE | CLICK HERE |

| CHANGE ADDRESS IN AADHAR | CLICK HERE |

| UPDATE AADHAR ONLINE | CLICK HERE |

| OFFICIAL WEBSITE | CLICK HERE |

WhatsApp Channel

FAQs: How to Get New E-PAN Card Instantly Free Online

Yes, if you apply through the official Income Tax website.

You can download your PAN card for free from the Income Tax e-Filing portal (using Aadhaar OTP) or via DigiLocker. NSDL and UTIITSL also offer free downloads within 30 days of PAN issuance. After that, a small fee applies.

Yes. You can download PAN using your PAN number or acknowledgment number through NSDL or UTIITSL portals. Aadhaar is required only for the instant e-PAN facility on the Income Tax portal.

If you’re downloading from NSDL or UTIITSL after 30 days, you’ll need to pay a nominal fee, usually ₹8.26 and to with Physical and e-Pan both cost ₹66. The e-Filing portal, however, remains free.

Yes. An e-PAN is fully valid for all financial, legal, and tax-related purposes. It carries the same authority as a physical PAN card and is accepted by banks, income tax departments, government offices, and private institutions.

I am a curious person, and Digital Information is at the top of my list of interests. I have a keen interest in writing. I write articles in various categories, how to, government-related online works, and information about government schemes. I put words in a simplified manner and write easy-to-understand articles.