Last updated on October 7th, 2025 at 06:00 pm

Get new e-PAN card instant free, Instant e-PAN card apply online free, Free e-PAN card download online, New e-PAN card apply free, Get instant e-PAN from Aadhaar free, Apply for e-PAN card free online, Download new e-PAN card free, ई-पैन कार्ड ऑनलाइन फ्री अप्लाई, फ्री ई-पैन कार्ड डाउनलोड ऑनलाइन, Know all about your query.

How to Get New E-PAN Card Instantly Free Online-नया ई-पैन कार्ड तुरंत मुफ़्त ऑनलाइन कैसे बनाये?

Need a new PAN card but don’t want to wait weeks for it to arrive? The good news is, you can now get a new e-PAN card instantly free online without lengthy paperwork or waiting for weeks. No paperwork, no fees, no stress.

In today’s digital India, your PAN (Permanent Account Number) is more than just a tax ID—it’s your financial identity. Whether it’s opening a bank account, filing income tax returns, or applying for a loan, PAN is a must-have. But what if you don’t have one yet?

In this guide, I’ll walk you through everything you need to know: how to apply, download, track, and use your free e-PAN card instantly.

What is an e-PAN Card?

An e-PAN card is simply the digital version of the physical PAN card. It’s issued in PDF format, looks just like the plastic card, and carries your PAN number, name, date of birth, and photo. The only difference? You don’t have to wait days or pay for it—it’s generated instantly online.

Since it’s digitally signed by the Income Tax Department, it holds the same legal validity as the physical PAN. Whether you need it for filing taxes, opening a bank account, or applying for a loan, your e-PAN works everywhere.

Why Should You Get an Instant e-PAN?

Here’s why the e-PAN is a game-changer:

- It’s Free – No charges if you apply through the official Income Tax portal.

- It’s Instant – Usually generated in just 10–15 minutes.

- It’s Paperless – No documents required, just Aadhaar-based OTP verification.

- It’s Convenient – Download anytime from the Income Tax website.

- It’s Valid Everywhere – Accepted for all financial and government purposes.

INCOME TAX DEPARTMENT OF INDIA

| Name of Article | How to Get New E-PAN Card Instantly Free Online |

| Objective | नया ई-पैन कार्ड तुरंत मुफ़्त ऑनलाइन कैसे बनाये? |

| Mode | Online |

| Charges/Fee | Free of Cost |

| Official Website | CLICK HERE |

Who Can Apply for a Free e-PAN? | Eligibility for Free Instant e-PAN

Not everyone can use this facility. Here’s the eligibility checklist:

- You’re an Indian citizen.

- You don’t already have a PAN.

- You have a valid Aadhaar number.

- Your Aadhaar is linked with your mobile for OTP verification.

- Your Aadhaar details (name, DOB, gender) are correct.

- HUFs, companies, and trusts are not eligible.

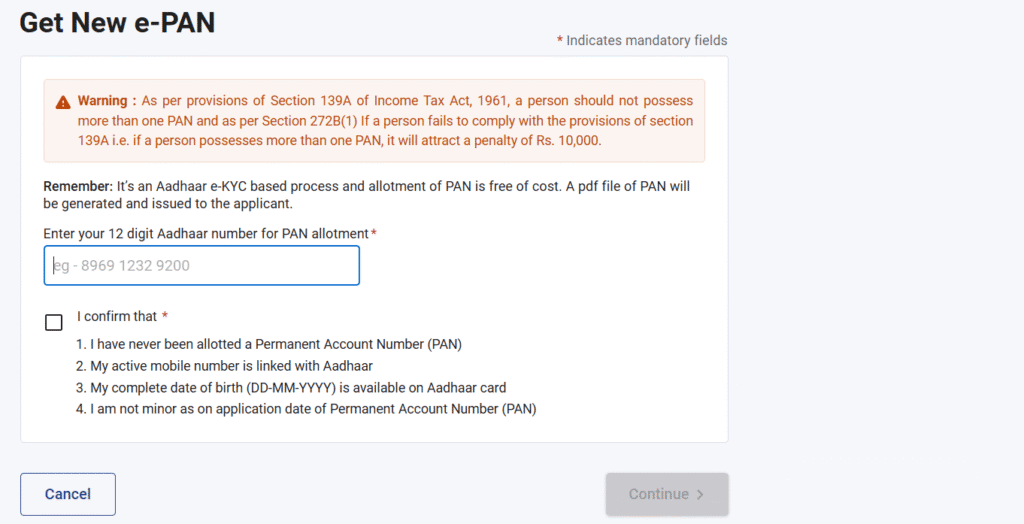

Important: If you already have a PAN, don’t try to apply again. Holding more than one PAN can attract a penalty of Rs. 10,000.

Fee to Apply for Instant e-PAN Online

The Instant e-PAN facility provided by the Income Tax Department of India through the e-filing portal is absolutely free of cost.

- No application fee

- No processing charges

- No delivery charges (since it’s issued in digital format)

Documents Required for Free e-PAN Card

The biggest advantage of the e-PAN system is that it is document-free. Unlike the old process, you don’t need to submit multiple proofs of identity, address, or photographs. The only “document” required is your Aadhaar card.

Key requirements include:

- Aadhaar Number (mandatory)

- Linked Mobile Number (for OTP authentication)

- Linked Email ID (optional but recommended for receiving e-Pan)

That’s it—no photographs, no signatures, no physical documents. This makes the entire process effortless and highly convenient.

Read Also:

Step-by-Step Guide: How to Apply for e-PAN Card Instantly Free Online

To Transfer voter ID card after marriage online, follow these simple steps:

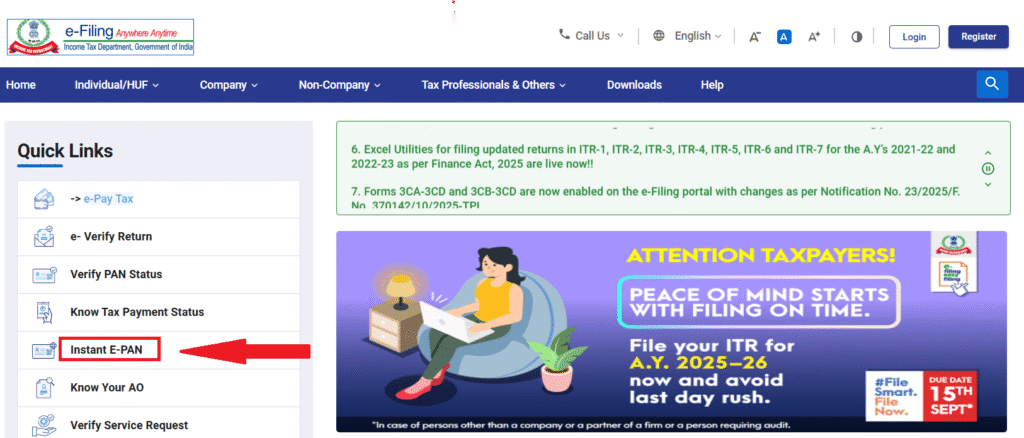

Step 1: Visit the Income Tax e-Filing Portal (https://www.incometax.gov.in).

Step 2: Go to the Quick Links section and select Instant e-PAN.

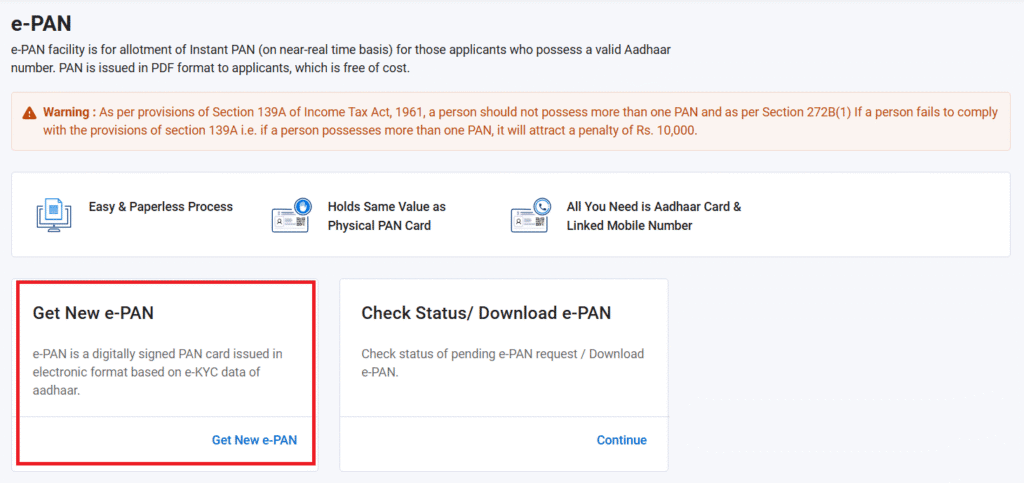

Step 3: Click on Get New e-PAN.

Step 4: Enter your Aadhaar number and accept the terms and conditions.

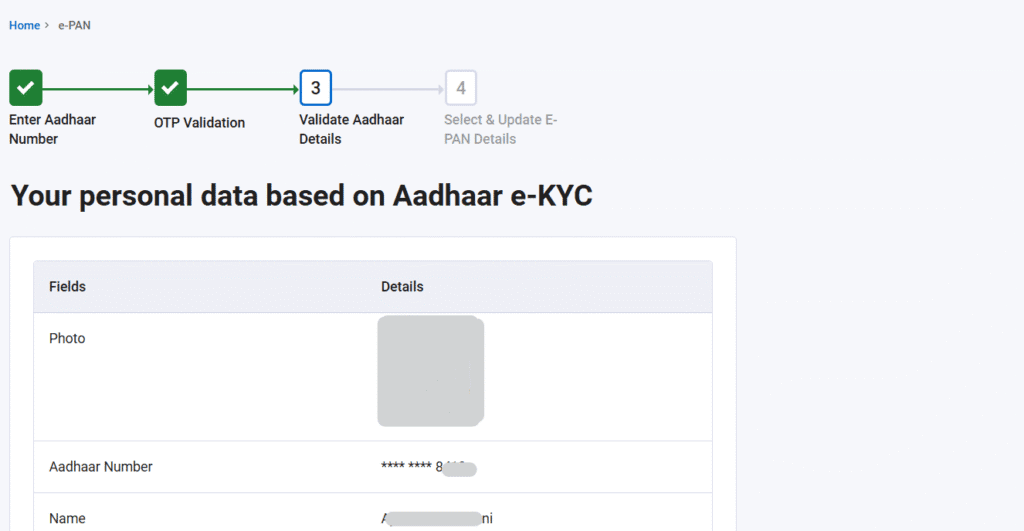

Step 5: Authenticate your Aadhaar details using the OTP sent to your registered mobile number.

Step 6: After your Aadhaar details are validated, they will appear on the screen. Carefully check all your details and your email ID. If your email ID is already linked with Aadhaar, simply validate it. If not, enter your email ID, validate it, and then click on Continue.

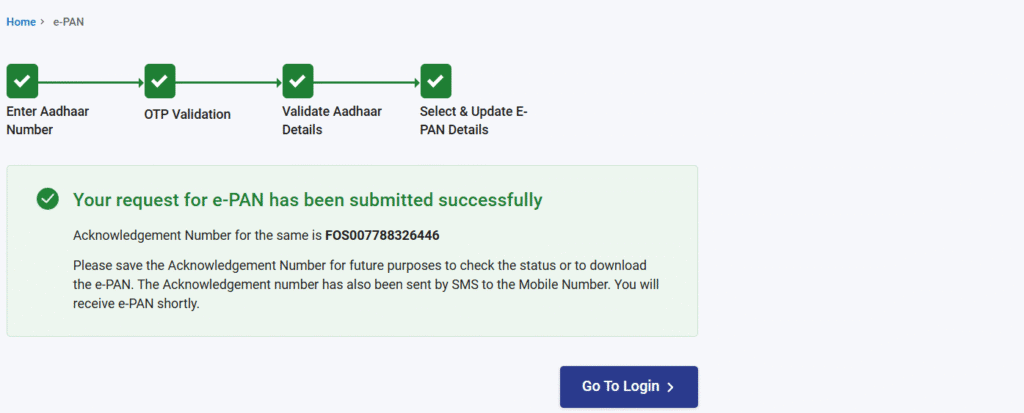

Step 7: Your request for an Instant e-PAN card (free online) has been submitted successfully. Please note down your acknowledgement number for future reference.

Step 8: Now you will be able to check your application status and download your e-PAN within a few minutes.

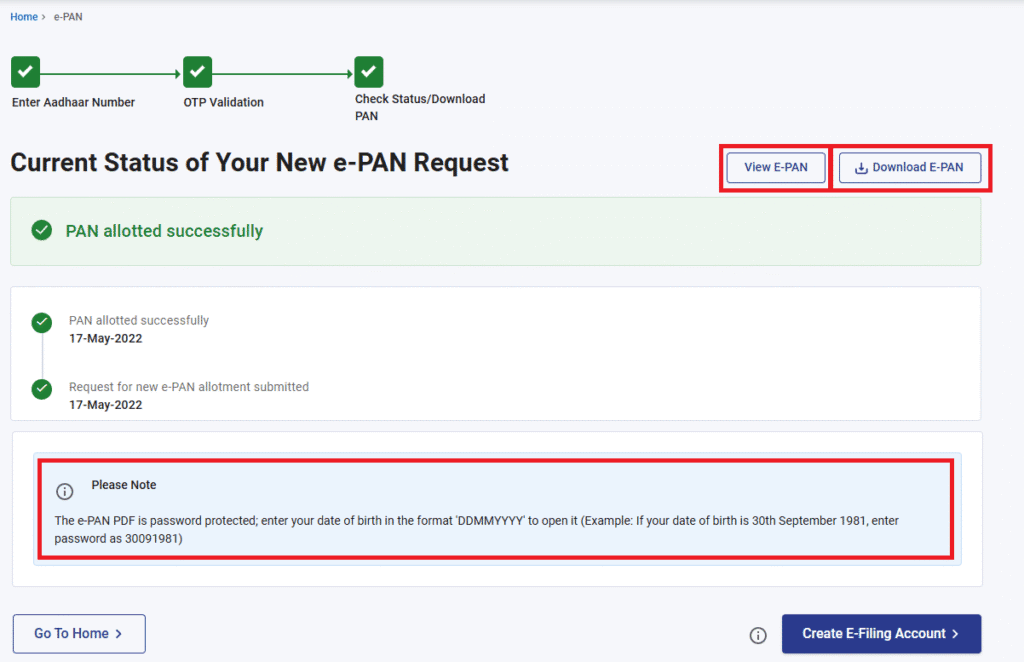

How to Download Instant e-PAN Card: Step By Step Guide

After successfully applied for an Instant e-PAN Card through the Income Tax Department (ITD) portal, you can easily download it online. Follow these steps:

Step 1: Go to the Income Tax e-Filing Portal (https://www.incometax.gov.in).

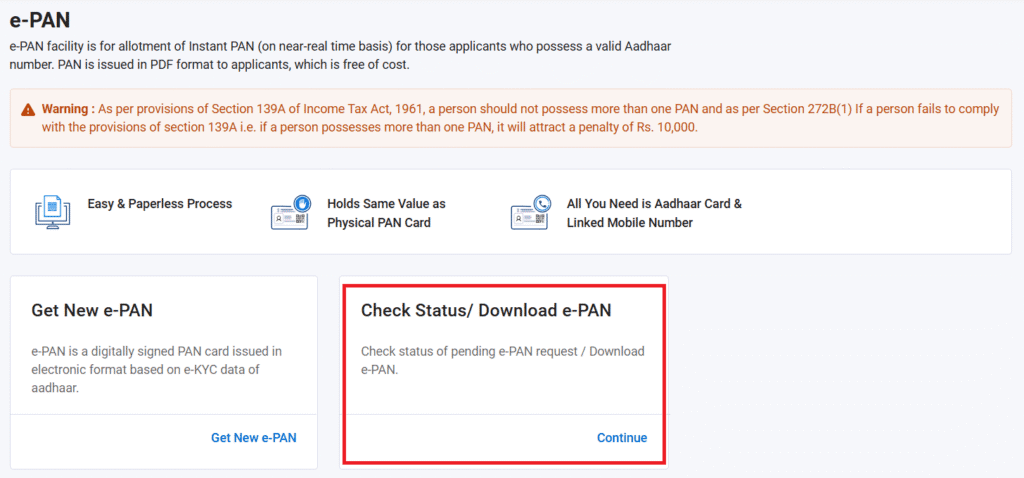

Step 2: On the homepage, under the Quick Links section, select Instant e-PAN.

Step 3: You will see two choices on the screen. Click on Check Status / Download PAN to proceed.

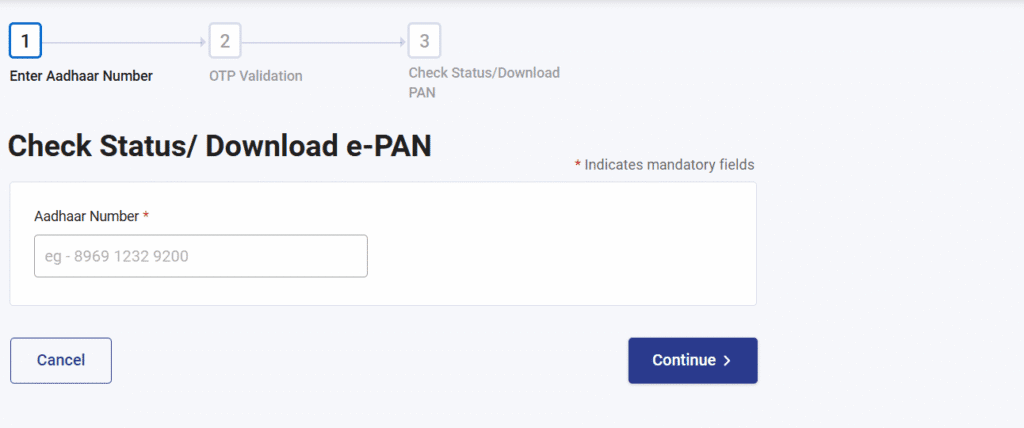

Step 4: Type in your 12-digit Aadhaar number that you used during your e-PAN application.

Step 5: An OTP (One-Time Password) will be sent to your registered mobile number linked with Aadhaar. Enter the OTP to continue.

Step 6: If your PAN has already been allotted, you will see the Download e-PAN option. Just click on it, and your e-PAN will be saved as a PDF file.

Conclusion

Getting a PAN card no longer has to be a slow, complicated process. With the instant e-PAN facility, you can apply online, verify with Aadhaar OTP, and download your PAN instantly—for free.

Whether you’re a student, freelancer, or business owner, this service saves time, money, and effort. Plus, since the e-PAN is valid everywhere, you don’t need to worry about waiting for a physical card.

So, if you haven’t already, go ahead and apply for your free e-PAN today. It’s one of the smartest and simplest government services available right now.

You will receive your e-PAN card in PDF format on your registered email ID. You can also download it directly from the portal. The PDF is password-protected, and the password is your Date of Birth in DDMMYYYY format.

| IMPORTANT LINK | |

| LINK MOBILE WITH VOTER ID | CLICK HERE |

| UPDATE VOTER ID ONLINE | CLICK HERE |

| CHANGE ADDRESS IN AADHAR | CLICK HERE |

| UPDATE AADHAR ONLINE | CLICK HERE |

| OFFICIAL WEBSITE | CLICK HERE |

Read More:

FAQs: How to Get New E-PAN Card Instantly Free Online

Yes, if you apply through the official Income Tax website.

Not necessarily. e-PAN is accepted everywhere, but you may still order a physical PAN if you want a hard copy.

Usually within 10–15 minutes, sometimes up to 48 hours.

No, applying for more than one PAN is illegal and can attract penalties.

Yes, e-PAN has the same legal validity as the physical PAN card.

I am a curious person, and Digital Information is at the top of my list of interests. I have a keen interest in writing. I write articles in various categories, how to, government-related online works, and information about government schemes. I put words in a simplified manner and write easy-to-understand articles.